Largest part of the incomes received by the commercial banks are sourced from the penalties/fines

Mistrust of some part of the society towards the commercial banks, is one of the popular issues. There are many reasons, including the one which refers to the incomes received by the commercial banks that are sources from the fines. There is a popular notion among people: "Largest part of the incomes received by the commercial banks are sourced from the penalties/fines."

"Society and Banks" focused on the incomes of the commercial banks and checked the views of the society.

For analyzing this data, we have reviewed data of 3 quarters for the first quarter of 2014 of five the largest commercial banks in Georgia: Bank of Georgia, TBC, ProCredit, Bank Republic ad BasisBank (Data of four quarters of Liberty Bank about such incomes were not available in dynamics).

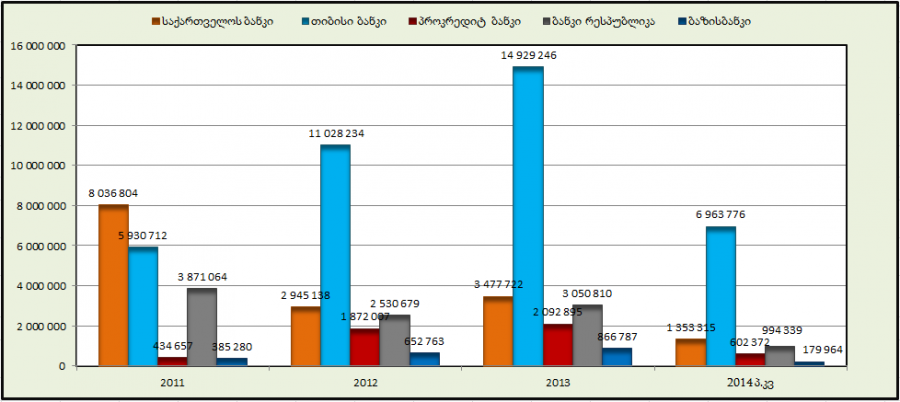

Diagram #1: Incomes received from the penalties/fines according to the loans issued on the customers (in Gels)

Source: nbg.ge

As #1 diagram shows that incomes of the Bank of Georgia received from the penalties/fines reached its peak in 2011-2013, namely in 2011 - 8,037 thousand Gels. In 2012, it decreased for 3 times (2,945 Gels), and in 2013 it has increased a little (3,477 thousand Gels).

As for TBC Bank, incomes received from the penalties/fines shows continuous growth tendency in 2011-2013. In 2012, incomes increased twice in comparing with 2011, and 1.4 times in 2013.

Like TBC Bank, similar marks of ProCredit Bank was continuously increasing in 2011-2013. In 2012 it has increased four times and in 2013, for 1.12.

Incomes received from the penalties/fines of the Bank Republic in 2011-2013, reached its peak in 2011 - with 3,871 thousand Gels. In 2012, incomes decreased with 1.5 and in 2013 with 1.2.

As for Basis Bank, like TBC Bank and ProCredit Bank, similar marks were characterized with continuous growth in 2011-2013. In 2012, incomes increased for twice and in 2013, it has increased with 1.3. Diagram also shows that pursuant to the incomes received from the penalties/fines in 2011, first place is taken by the Bank of Georgia, respectively followed by TBC Bank, Bank Republic, ProCredit Bank and the final fifth place is taken by Basis Bank.

From 2012 to the present day, Bank of Georgia moves from the first place to the second, replaced by TBC Bank. Respectively, third place is taken by Bank Republic, followed by ProCredit Bank and Basis Bank.

At the first sight, given data seems to be high, though it is not true. As the incomes received from the penalties/fines belongs to interest incomes of the commercial banks, thus, we have reviewed them in correlation with the total interest incomes (interest incomes includes the following: interest incomes from the banks "Nostro" accounts and deposits, from the loans (trade and services, power, agricultural field and other loans), interest and discount incomes from the obligations, interest incomes from the penalties/fines of the customers' loans, etc).

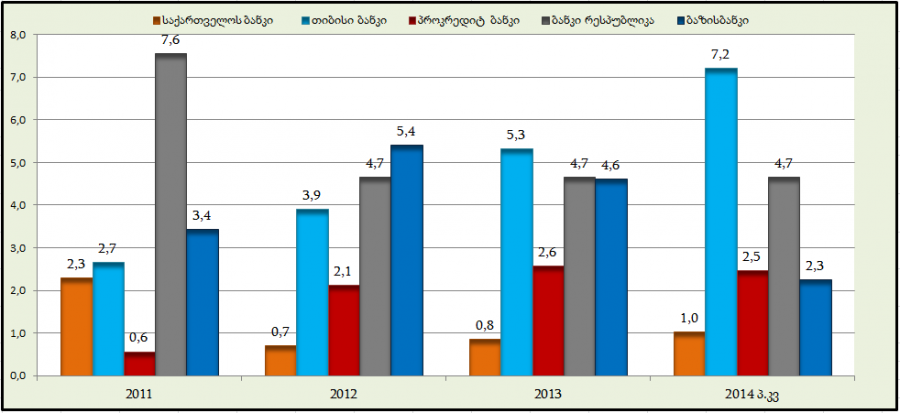

Diagram 2. percentage of the incomes received from the penalties/fines in the total interest incomes

Source: nbg.ge

#2 Diagram shows that, in 2011, Bank Republic shows that the incomes received from the penalties/fines (7.6%) takes the largest portion of the total interest incomes. Basis Bank takes the second place with 3.4% (as #1 diagram shows that the incomes received be these two banks from the penalties/fines are not high in comparing with the data of other banks, we can conclude that the entire interest incomes of the Bank Republic and Basis Bank was far lesser in 2011), followed by TBC Bank on the third place with 2.7%, Bank of Georgia with 2.3% and ProCredit Bank with 0.6%.

In 2012, Basis Bank takes the first place with 5.4%, followed by Bank Republic with 4.7%, TBC Bank - 3.9%, ProCredit Bank - 2.1% and the last fifth place is taken by the Bank of Georgia with 0.7%.

In 2013, TBC Bank took the first place, followed by the Bank Republic, Basis Bank, ProCredit Bank and the Bank of Georgia on the fifth place, respectively.

As for the data of the first quarter of 2014, like 2013 year, first and second place is occupied by TBC Bank and Bank Republic, respectively, followed by ProCredit Bank, Basis Bank and the Bank of Georgia on the fifth place. Pursuant to the amount of incomes received from the penalties/fines in the first quarter of 2015, Bank of Georgia takes the second place among the 5 banks, we have reviewed, though it takes the final place according to the share in the total interest incomes. This means that the total interest incomes of the Bank of Georgia was reasonably high in the first quarter of this year.

Analysis distinctly reveals that the percentage of the incomes received from the penalties/fines in the total interest incomes of the commercial banks varies between 0.6%-7.6%, which are very low. For the informational purposes, let's discuss the percentage of the incomes received from the penalties/fines through the total incomes of the commercial banks.

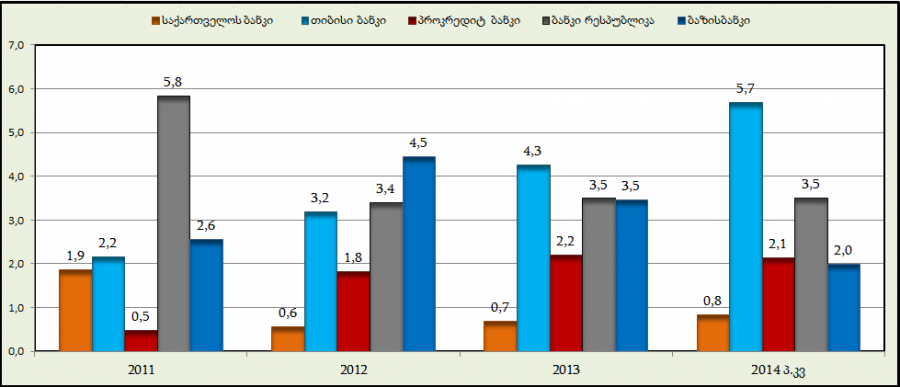

Diagram 3. Percentage of the incomes received from the penalties/fines through the total incomes of the commercial banks

Source: nbg.ge

Diagram #3 clearly shows that, the percentage of the incomes received from the penalties/fines through the total incomes of the commercial banks is similar to #2 diagram. Naturally, this data is less then the percentage of the incomes received from the penalties/fines and varies between 0.5%-5.8%, which are very low as well.

Conclusion

We have researched that, at the first sight, incomes of the five largest commercial banks () from the fines are large, though in comparing with interest incomes it is 0.6%-7.6% and in comparing with the total incomes of the commercial banks, it is 0.5% - 5.8%, which are very low marks.

Summing up the above said, we conclude that the notion spread among some part of the society saying that "Largest part of the incomes received by the commercial banks are sourced from the penalties/fines" - is mostly false.